Search and preparation fees: Electronic records

Presentation at the Canadian Access and Privacy Association Conference

by Megan Regnier, Investigator, and Diane Therrien, Legal Counsel

November 30, 2015

Ottawa, Ontario

(Check against delivery)

PowerPoint version of the presentation

Authorized fees for search and preparation

The Act:

- 11(2) The head of a government institution to which a request for access to a record is made under this Act may require, in addition to the fee payable under paragraph (1)(a), payment of an amount, calculated in the manner prescribed by regulation, for every hour in excess of five hours that is reasonably required to search for the record or prepare any part of it for disclosure, and may require that the payment be made before access to the record is given.

- 77(1)(d) authorizes the Governor in Council (i.e. Cabinet) to make regulations prescribing the manner of calculating these fees

The Regulations:

- 7(2) Where the record requested...is a non-computerized record, the head of the government institution may ... require payment in the amount of $2.50 per person per quarter hour for every hour in excess of five hours that is spent by any person on search and preparation.

A brief history of the application of fees to computerized records

- The Act and its regulations relating to search and preparation fees were drafted in the early 1980s, at a time when personal computers were not used generally in government institutions. Since then, there has been a shift from paper-based to electronic records. Personal computers, laptops and tablets are now widely used in the federal government.

- Previous Information Commissioners had not distinguished between computerized and non-computerized records in the investigation of search and preparation fees.

- For example, in an investigation described in the 2006-2007 Annual Report, the then-Commissioner concluded that a government institution could assess search fees, per subsection 7(2) of the Regulations, in relation to the retrieval of archived e-mails.

Genesis of the Commissioner’s interpretation

- The current Information Commissioner came to her view about which records are computerized following an investigation into a complaint which she reported in her 2011-2012 Annual Report. The investigation involved the application of search and preparation fees to electronic records, such as emails and word-processing files, by DFAIT.

- DFAIT took the position that the fees could be charged for electronic records.

- The Commissioner reported her finding to the Minister of Foreign Affairs and International Trade in November 2011: In her view, the term “non-computerized” applied to records which were not stored in a computer or in electronic format. She recommended that DFAIT cease charging fees for search and preparation of electronic records.

- DFAIT indicated that until the fee regime was modernized, it would maintain the current practice to assess and charge search and preparation fees when processing voluminous records as authorized by regulation.

The investigation that gave rise to the Court reference

- The same question arose in a complaint about a search fee of over $4000 assessed by Human Resources and Skills Development Canada (HRSDC) to search for records responding to a request for system user manuals concerning a database, a user interface, as well as developer’s “changelogs” in relation to the database system.

- The Commissioner found that the complaint was well-founded and recommended that HRSDC cease charging fees for the search and preparation of electronic records.

- HRSDC maintained its view that, given a contextual analysis reflecting the intent of Parliament at the time of enacting the legislation, search fees should be chargeable for the records, which would be considered non-computerized.

- The Commissioner opted to pursue the matter in Federal Court, by way of a reference, before reporting the results of the investigation to the complainant.

The reference

Application filed in Federal Court on February 27, 2013 by the Information Commissioner

- A reference is a type of proceeding where an administrative decision-maker asks the Court to determine a question of law, jurisdiction or procedure.

- The Commissioner had advised the Minister in the HRSDC investigation that if HRSDC did not implement her recommendations, she intended to seek guidance on the interpretation of the Regulations before the Federal Court.

- On February 27, 2013, the Commissioner filed a reference application pursuant to section 18.3 of the Federal Courts Act, the provision which allows for such a mechanism. The respondent was the Attorney General of Canada.

- This was the first time that an Information Commissioner had used the Reference process.

-

At issue in this case was whether electronic records such as email or Word documents could be considered “non-computerized.”

-

The reference question was framed as follows:

-

Are electronic records non-computerized records for the purpose of the search and preparation fees authorized by subsection 11(2) of the Access to Information Act (the Act) and subsection 7(2) of the Access to Information Regulations (the Regulations)?

-

The motion to strike the Commissioner’s reference application

- The Attorney General argued that one of the conditions for the Court to hear the reference had not been met: that the issue must be one for which the solution can put an end to the dispute before the Commissioner.

- On February 6, 2014, the Court dismissed the motion to strike the reference (2014 FC 133).

- The Court found that the Attorney General’s argument did not take into account the final step of the Commissioner’s statutory duty—that is, to report to the complainant, which the Commissioner had yet to do.

- In addition, the Court noted that if it were to accept the Attorney General’s argument that the Commissioner’s role is not to resolve disputes, this would mean that the Commissioner would never be able to bring a reference.

- The Court concluded that it was certainly arguable that Parliament had intended for advisory bodies such as the Commissioner to have the right to refer to the Court issues of law arising in the performance of their duties.

Positions on the reference application

- The Commissioner’s view was that electronically stored records are indeed computerized and therefore not subject to search and preparation fees.

- The Attorney General argued that a contextual analysis should be applied, which would take into account that most records are now in electronic form and that Word documents or emails “can be produced without the need to program a computer to create the record.”

- VIA Rail Canada, the Canadian Air Transport Security Authority (CATSA) and the Business Development Bank of Canada (BDC) intervened in the reference as a group. They noted that charging such fees is useful because they can serve as a deterrent to requesters and can be used to help the financial situation within institutions that may be under budgetary and other constraints when responding to requests.

The decision

2015 FC 405, March 31, 2015

In the Court’s words

- The Court accepted the Information Commissioner’s position that the ordinary meaning of the words “non-computerized records” is the correct interpretation of that expression:

“In ordinary parlance, emails, Word documents and other records in electronic format are computerized records.”

- Records in electronic format are computerized and therefore not subject to search and preparation fees under the Regulations.

- Where there is no regulation authorizing it, no fee can be charged.

The Federal Court noted that “[t]here is a hint of Lewis Carroll in the position of those who oppose the Information Commissioner:

“[w]hen I use a word,’ Humpty Dumpty said, in rather a scornful tone, ‘it means just what I choose it to mean -- neither more nor less.’

‘The question is,’ said Alice, ‘whether you can make words mean so many different things.’

‘The question is,’ said Humpty Dumpty, ‘which is to be master – that’s all.’”

Following the Court's decision

Outcome for the OIC's existing complaint files

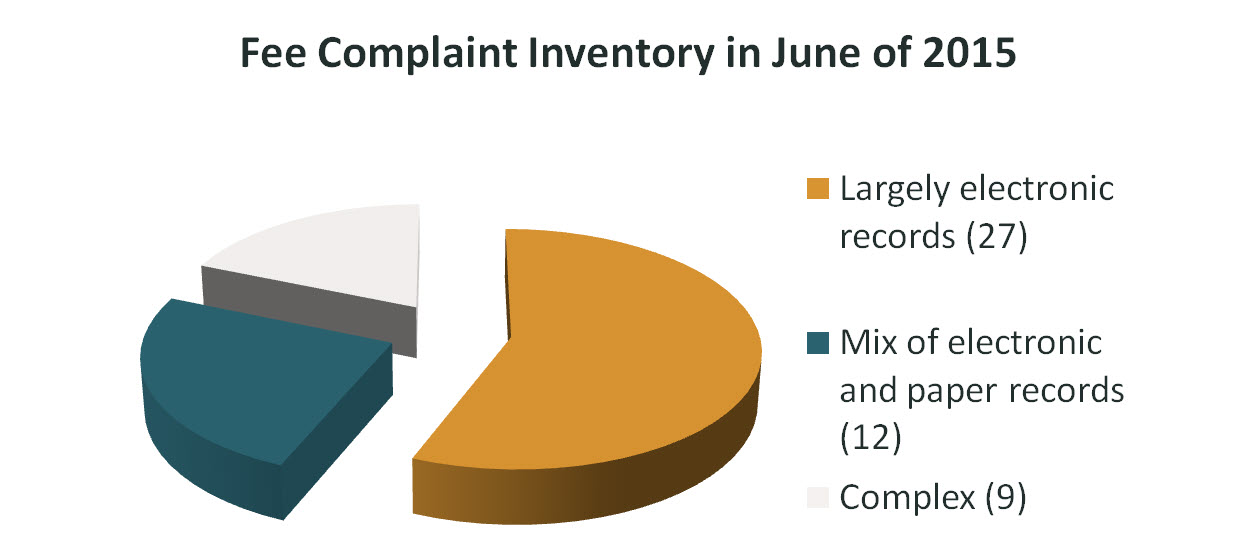

Inventory of fee complaints

Text version

Questions from institutions regarding our investigations, interpretation and findings

- What to do with a file that has effectively been closed by the institution?

- Does the Court’s decision apply to both search and preparation of records?

- We have printed and electronic copies of the same records. Can we charge for search and preparation of the paper copies?

- Is there any flexibility regarding the finding?

Currently

To date 42 files have been resolved: Forty (40) were well-founded; Two (2) were discontinued.

- Many were concluded swiftly with agreements to process the requests without assessing further fees or requiring payment of any fees

- In the few instances where fees had been paid, complainants were reimbursed

- Some complainants amended their requests to receive only electronic records, resolving the question of whether any fees should be assessed

Impact of the decision: Moving forward

- The Information Commissioner will be issuing an advisory notice on fees. The ATIP community was consulted for comments on a draft of this notice and we thank you for your input.

- http://www.oic-ci.gc.ca/eng/inv-inv_advisory-notices-avis-information.aspx

- Institutions must not charge fees to search for, and prepare, electronic records.

- Fees charged for searching and preparing electronic records are not permitted under the Act and will result in well-founded complaints.

- Subsection 7(3) cannot be used to justify charging fees for what are, for all intents and purposes, fees for searching and preparing electronic records.

- Fees cannot be charged to deter requesters or for cost recovery. Such use of subsection 7(3) – or any other provision – is not permitted under the Act and will result in well-founded complaints.

Reminder

Fees can be waived or reimbursed

- Subsection 11(6) of the Act allows for fees to be waived or reimbursed by the head of an institution (or delegated authority). This provision gives the head of an institution (or properly delegated authority) broad discretion to waive or reimburse fees in any circumstances considered appropriate.